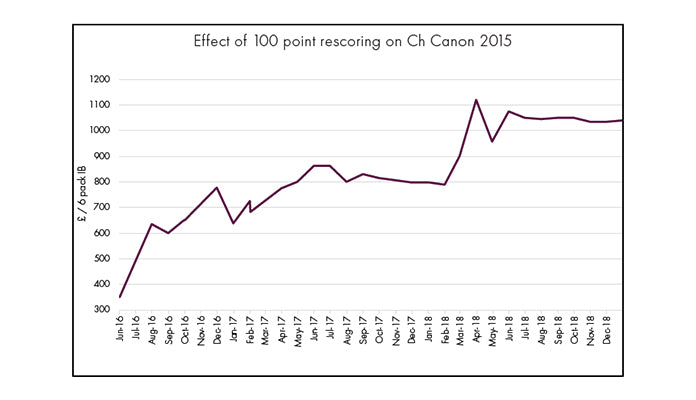

CH CANON 2015: THE POWER OF CRITICS’ SCORES

Then, in February 2018 Ch Canon was re-scored by two major critics, Neal Martin and Antonio Galloni, who both awarded the wine 100 points. These two perfect scores, alongside encouraging tasting notes, such as ‘2015 Canon was a benchmark wine that seemed to revitalize this historic estate’ and ‘2015 Canon is simply extraordinary in every way’, paved the way for a further price increase of 42% to £1,120 in a matter of days.

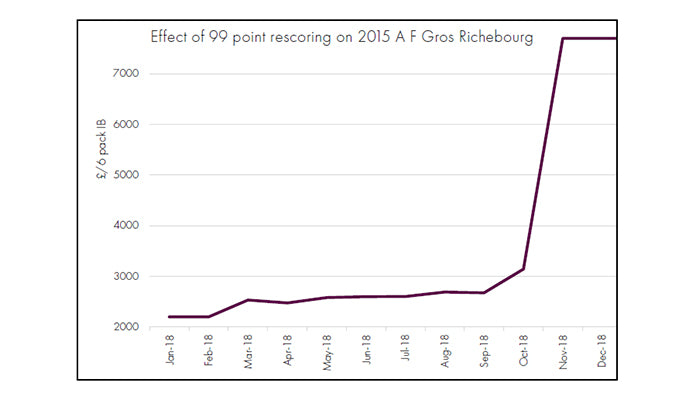

CH MONTROSE 1996 & RICHEBOURG A F GROS 2015: WHAT IS RESCORING, AND WHAT DOES IT DO?

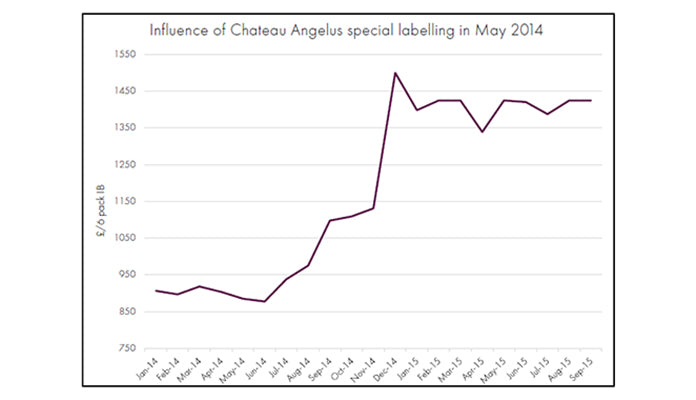

MOUTON 2000, ANGELUS 2012 AND ORNELLAIA

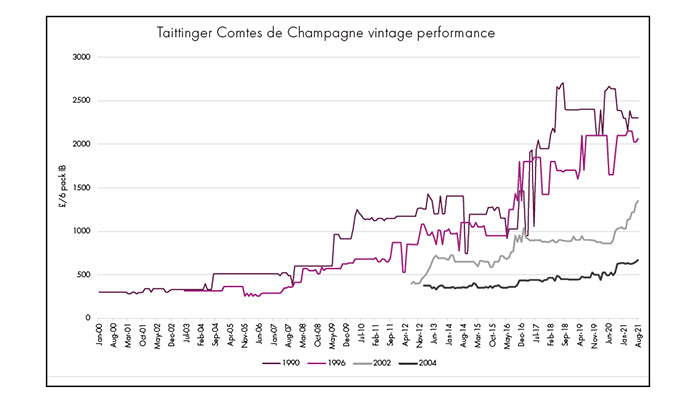

TAITTINGER COMTES DE CHAMPAGNE | THE MAGIC OF MATURITY

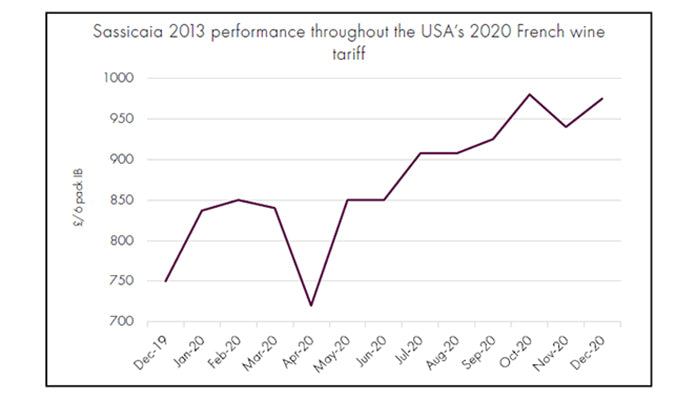

SASSICAIA 2013 | GEO-POLITICS AND MACRO SCALE INFLUENCE

supply due to US tariffs, the price jumped a further 30%, bringing the price from £750 to £975 per 6 bottles.

INTERESTED IN WINE INVESTMENT? SIGN UP HERE

Fill in your details to receive our Wine Investment in a Nutshell brochure and hear more about wine investment from our team.

By submitting this form, you are consenting to receive marketing emails from: Goedhuis & Co, Reg No. 1569585, Reg Office, 3rd Floor 12 Gough Square, London, EC4A 3DW, GB, https://www.goedhuis.com. You can revoke your consent to receive emails at any time by emailing wine@goedhuis.com.