Brexit Boost

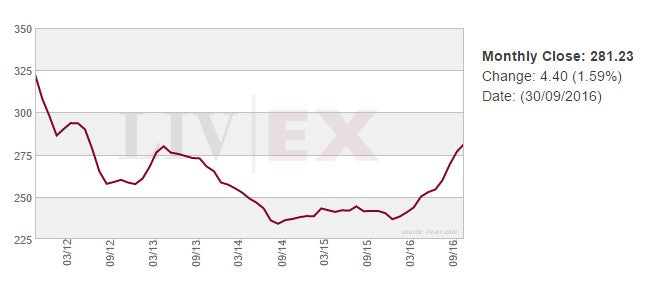

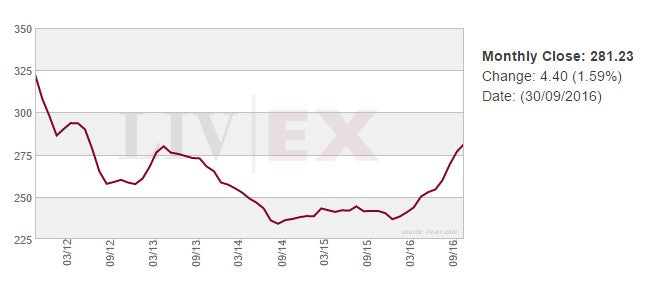

The third quarter was more lively than one might have expected. The agent for this unseasonal activity was Sterling’s collapse after the UK’s decision to exit the EU. Overnight Euro based buyers enjoyed a discount of some 10%, this rising to 13% for US Dollar markets.Merchants and collectors needed no second invitation as stock lists were plundered. Our Far East trading arm based in Hong Kong has been particularly busy capitalising on this opportunity. The Liv-ex 100 gained a remarkable 8% over the quarter.

The Liv-ex Fine Wine 100: the industry’s leading benchmark, representing the price movement of 100 of the most sought-after fine wines for which there is a strong secondary market. The majority of the index consists of Bordeaux although wines from Burgundy, the Rhone, Champagne and Italy are also included.

To put this into context, a year earlier Q3 2015 saw the index retreat 0.8% and the last time the index enjoyed such gains was back in the heady days of early 2011, which as it happened heralded an unfortunate turn in the market’s direction. This time around there are no such fears, the boost coming at time when prices have stalled for nearly 18 months.

The gains of the beginning of the year have been consolidated and, with continued pressure on supply coupled with Sterling’s ongoing peril (hard Brexit now sending the currency markets into paroxysms of pessimism), it would seem further price rises can be expected.

However, one cloud on the horizon might just be buyer’s alarm: with the last market peak a recent (and possibly painful) memory for some participants, a little circumspection might be expected to temper more bullish spirits.

Mixed Messages

The 2015 Bordeaux En Primeur campaign was a mixed bag for a number of reasons. From the outset critics were divided as to exactly where or perhaps how consistently quality could be found. As our Master of Wine David Roberts stated at the time:

“In 2015 there are some absolutely wonderful wines, with the vintage’s hallmarks of succulently ripe yet pure fruit, fresh acidity and fine supple tannins. Others were less successful and careful selection will be critical.”

The heterogeneous nature of the vintage combined with wary consumer sentiment was far from an ideal environment, though happily timing-wise the Bordelais did manage to conclude matters two days prior to the Brexit vote.

The success stories involved those chateaux that produced pre-eminent wines: Giscours, Canon and Figeac spring to mind, and those chateaux that managed to restrain their more ambitious pricing tendencies and offer the collector value when compared to physically available vintages, whether in the top echelon, such as Haut-Brion & Margaux, or elsewhere.

En primeur is in a period of change but as shown in 2015, the opportunities for success are there. Whether the chateaux take them in the future remains to be seen.

Autumn Activity

The recent upturn in prices and sentiment is to be welcomed, there has been little to cheer for some time now. However, despite remarkable gains of late, the recovery is still in its infancy, predicated as it is on Sterling’s woes and it would no great surprise if there was a pause for breath in the final three months of the year. It has been a while since collectors had the opportunity to take some profit and if there were to be a sell off, buyers’ confidence is still far from resolute.

PDF download: Goedhuis Market Report October 2016

Written By

Written By